In the ever-evolving landscape of cryptocurrencies, a new contender has emerged: Kaspa. This innovative digital currency is beginning to garner attention, especially when juxtaposed with the industry behemoth, Bitcoin. While Bitcoin has established itself as the gold standard in the cryptocurrency realm, offering unparalleled liquidity and widespread acceptance, Kaspa poses intriguing possibilities for those looking to invest in or mine cryptocurrencies. But when it comes to hosting services and profit potential, how do these two giants compare?

At its core, cryptocurrency mining involves verifying transactions on a blockchain and, in return, miners receive rewards in the form of the currency being mined. Bitcoin mining is synonymous with powerful hardware, electricity consumption, and the need for adequate cooling systems. As the difficulty has increased over the years, miners have transitioned from utilizing personal computers to deploying sophisticated mining rigs that maximize profitability. However, the question remains: What about less established coins like Kaspa? Are investors missing out on an opportunity with this emerging altcoin?

One of the first considerations for potential investors looking to mine Bitcoin or Kaspa is the hosting service prices. Mining farms offer a solution for those who don’t want to grapple with the complexities of setting up and managing hardware in their homes. Instead, they provide a controlled environment optimized for mining, where the photons of performance are maximized. This brings us to the crux of the issue: are hosting services cost-effective when it comes to Kaspa versus Bitcoin? The answer lies in the profit margins…

The initial expenses for hosting a mining rig can be daunting. They typically encompass the cost of hardware, hosting fees, electricity costs, and more. Bitcoin mining’s enormous energy requirements have led many to seek hosting services that can offer competitive rates. Meanwhile, with Kaspa’s unique blockchain technology—specifically its ability to perform rapid transactions—those lower entry costs could mean that hosting services tailored for Kaspa might be more attractive for beginners and seasoned investors alike.

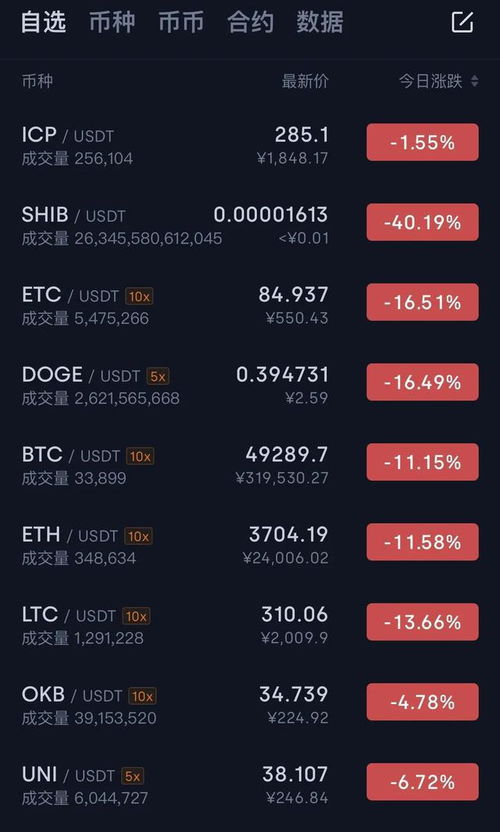

For those eyeing profit potential, examining market trends and the current price points of both Bitcoin and Kaspa is essential. Bitcoin’s well-documented volatility often creates opportunities for profit, yet it has established a level of stability that more nascent cryptocurrencies like Kaspa cannot yet claim. As the blockchain environment matures, and as adoption increases, we may witness Kaspa’s price surge, leaving early investors to potentially capitalize on skyrocketing valuations.

For many, altcoins provide a chance to diversify investment portfolios. Ethereum, Dogecoin, and Kaspa represent some of the most current alternatives to Bitcoin. Their respective networks may not enjoy the same level of trust as Bitcoin, but they each carve out significant niches in the crypto ecosystem. While Bitcoin continues to reign supreme, the dynamic nature of cryptocurrency suggests that opportunities exist beyond its shadow. Investors increasingly recognize that exploring altcoins could yield substantial returns, thus fostering a burgeoning market for new hosting services tailored specifically to these currencies.

To sum it up, whether one is striving to mine Bitcoin or Kaspa—or even considering dabbling in Ethereum or Dogecoin—understanding the hosting landscape is paramount. Strategically positioning oneself to leverage the unique advantages of various cryptocurrencies can lead to significant profit potential. By staying informed and adaptable, investors can harness the power of mining to achieve their financial goals.

Ultimately, with the right strategies in place, deciding between Kaspa and Bitcoin isn’t merely about which coin holds the highest market value at the moment; it’s about understanding the nuanced layers of hosting service prices and mining potential. In the fast-paced world of cryptocurrencies, flexibility is key, and with fluctuations in value, new mining technology, and ever-evolving hosting services, the opportunity for substantial gains—or losses—lurks around every digital corner. The careful investor will keep a watchful eye on these developments, eager to seize the next wave of potential profits.